Perspectives

The 2022 Narwhal List – Astounding Success

From only two Unicorns at the end of 2020 to 19 today shows the incredible growth in just one year in the Canadian tech ecosystem. We recently released our 2022 Narwhal List which showcases those private Canadian tech companies that are scaling successfully as of...

Ranking Canada’s Accelerators

Recently, we have been trying to figure out what success means for an accelerator. We understand success from a company perspective but what is success for an accelerator? Does it mean the total value created, amounts raised by participants, employment, number of...

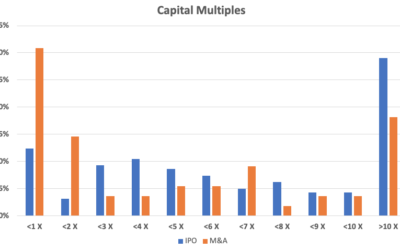

IPO versus M&A

I posted a blog last week about D2L’s recent IPO. In it I made what on the surface may appear to be a value judgement favouring an IPO over a merger as a means for entrepreneurs to exit. This is part of the IPO versus M&A debate. I got called on it by Nicole...

Good news: D2L is going public

I was excited to be able to look at the D2L prospectus today. (Nerd alert, lotsa numbers in this post.) They have been on the Narwhal List since inception and clocked in last year in 15th spot. Many years ago they and Hootsuite were the darlings of the Canadian tech...

What would you do if you lived in Buffalo?

I was searching the other day for a list of incubators and accelerators in the US that specialize in digital health. I was surprised to find how many specialize in that one sector. You can see a list of them here. The list isn't the point though, it's what I realized...

The Catch 22 of Canadian Seed Funding

I heard from an entrepreneur I know that a very prominent institutional investor turned down their request for Seed Round funding because the company is pre-revenue. There is no way this company can get to revenue without a reasonably large amount of funding and it...

The Surprising Way Initial Funding Drives Success

A number of years ago I had one of those AhHa! moments that one has when one is fiddling around doing research. Basically, I discovered the surprising way initial funding drives success. I was playing around with Crunchbase, looking at the 2,429 healthcare and...

How Much Seed Capital Should You Raise?

We were sitting on one of those lovely Zoom calls the other day at The Happenin Company, debating about how much seed capital we should raise. Of course the simple answer is raise as much money as you need to get to a Series A round in 18 to 24 months. But it helps to...

The Narwhal List 2021

We finally got around to launching the Narwhal List 2021. 2020 was another remarkable year for Canadian Narwhals. In particular, four companies from last year’s list went public. (Nuvei, Chinook Therapeutics, Repare Therapeutics, and Fusion Pharmaceuticals.) Five were...