Scaleup Research

What does it take to transition from Startup to Scaleup?

Scaleup research can tell us a lot about the process of building a successful tech company. The research presented here is the result of over 20 years spent in an attempt to figure out what factors lead to the creation of rapidly growing world class companies. It is the result of research that has gathered over 1 million data points on thousands of companies and is presented in over 40 research papers with more than 800 pages of analysis.

It covers topics such as market development and corporate finance as well as policy development and leadership. Fundamentally, it is a study of the economics of growth. This is one perspective of many valid ones about scaling and we are pleased to be part of a broader discussion on scaling.

The Class of 2014

December 2024 – Ten years have passed since Canada launched 260 technology companies that went on to raise over $500 thousand each and start the scaling journey. We thought it would be interesting to see how well those companies have performed and how our Class of 2014 compares with those in other countries.

The Missing Ingredient

August 2023 – This research was published by the CD Howe Institute to address the problems that Canada is having at scaling companies to a world class status. It ooks at how Canada’s scaling companies are performing in terms of size achieved, capital raised, and growth rates.

A Stakeholder Perspective on Success

November 2022 – For those of you who want to read a doctoral thesis on the VC industry, I’ve attached my thesis. Lots of good data in here looking at VC success and how it can me measured.

Debunking Canada’s Brain Drain Myth

March 2021 – Canadians spend a lot of time fretting over the so-called “brain drain” – the out- migration of skilled talent, particularly to the United States. Most recently, the discussion has focused on the loss of technology workers. But is Canada really losing substantial numbers of software engineers and computer scientists to the siren call of Silicon Valley and other foreign locales?

Intellectual Property 2.0

November 2020 –Technology, government and university leaders need to expand their concept of intellectual property. It’s no longer enough to think of Technical IP in isolation. To succeed today, we need to take a broader view in which Marketing IP and Process IP are recognized as intellectual property and, along with Technical IP, are equally valued and integrated within a new IP framework—IP 2.0.

Scaling up in a Recession

May 2020 – We are now nearly two months into a combined health and economic crisis. Many companies will have had a chance to address cash flow and strategic issues. Are you ready to examine your cash flow and strategic issues? Do you need a structured approach? Here is some guidance to help you make the right decisions about how to proceed.

Innovation Spending in a Recessoion

April 2020 – Recent recessions in 2001 and 2008 can give us valuable insight into what we should do to optimize the results from innovation spending in this new recession. There is a pattern to what successful firms have done in past recessions

The Myth of a Better Mousetrap

October 2019 – Commonly used productivity and innovation indicators show Canada’s innovation economy declining relative to other countries. Despite large public investments, Canada still trails most of the Organisation for Economic Co-operation and Development (OECD) countries in productivity.

Canadian Venture Capital Sufficiency

September 2019 – In Canada, access to venture capital (VC) is cited as a persistent barrier to the creation of world-class firms, prompting the development of programs and funds to overcome it. Policy is operating under the assumption that availability of VC funding is as much a problem today as it was years ago. But what is the current state of VC funds in Canada? Is there a gap? If so, why?

The Path to IPO

March 2019 – Over the last four years, there have been substantial changes in IPOs in the software world. Firms tend to wait longer to go public, while raising larger late-stage private rounds and eventually experiencing high public market valuations. We wanted to take a closer look at this trend with the objective to gain some insights into current practices. To that end, we looked at the results of 58 software companies that have gone public in the US since 2013.

Tech Founder Education

February 2019 – Startups succeed because of their founders, but what makes a successful founder? We wanted to find out what backgrounds founders were bringing to their companies, so we undertook research to determine the educational backgrounds of founders of over 300 technology companies.

Physical Tech – Part 2

Nov 2018 – This report is the result of a forum held in February 2018 on the challenges that companies in the physical technologies face in commercialization. Forum participants had a robust discussion around the challenges outlined in our previous report on Physical Technologies and identified a number of other commercialization hurdles.

The Land of Stranded Pilots

Oct 2018 – This report examines the shape of the health technology industry in Canada with a focus on three specific questions: Does Canada actually have a problem with health tech commercialization? If so, how extensive is that problem? And what is causing it?

Scaling Up

Sept 2018 – This report is full of growth metrics for software companies. The beginning section is on market size.

The Class of 2008

May 2018 – Our objective for this report was to analyze the ten-year trajectory of tech companies launched in 2008 in select jurisdictions around the world. We looked in detail at 983 companies created in 2008 in Canada, the US, France, Germany, and the UK. The analysis shows some progress we are making and points out some areas of concern.

Social Media

April 2018 –

In this study, we began to examine Canadian sales and marketing activities in greater depth by looking at social media practices of Canadian tech firms relative to companies in other regions around the world.

Canada’s Scaleup Potential

March 2018 – There seems to be a shift away from focusing on startups to focus on those companies in Canada that are scaling. This appears to have been predicated on the premise that Canada has become good at starting companies but is challenged at scaling them to world-class size. This Impact Brief has been designed to develop a framework to measure Canada’s startup and scaleup rate in the technology sector.

Creating World Class Companies

Feb 2018 – In this report we want to go back to the beginning and look at the nature of technology companies that are being formed in Canada.

Physical Technologies

Nov 2017 – In a prior report on patenting we identified that Canada has a significant problem in that it frequently doesn’t commercialize its own inventions. In this report, we wanted to look at whether part of that problem might be due to a lack of government support particularly in the area of Physical Technologies.

Great Expectations

Oct 2017 – In several prior reports we looked at the impact that smaller VC deal sizes has on the slower growth of Canadian companies and on the availability of late stage capital. For this report, we wanted to look at whether smaller deal sizes may be as a result of any action that entrepreneurs themselves are taking.

The Rich Get Richer

Sept 2017 – Canadian VC deal sizes continue to lag those in other countries and at the same time, the returns of Canadian VCs also lag American VC returns. Canadian VCs made a strategic decision to invest the way they did as they could just as easily have chosen to invest twice as much in half as many companies. This begs the question; does the smaller deal size result in smaller returns?

Government VC

August 2017 – If Canada’s problem now is our ability to create large, public and industry leading world-class companies, then we thought in this scaleup research it would be worthwhile to examine the ability of BDC’s venture capital division and MaRS Investment Accelerator Fund to pick and nurture world-class companies.

The CMO Search

June 2017 – The goal of this scaleup research was to examine and compare the quality of marketing leadership in Canadian and American tech companies. On the whole, we found that Canadian-based marketing leaders are less qualified and less experienced than their American counterparts.

Canada’s Patent Puzzle

May 2017 – The prevalent Canadian narrative is that as a country, we struggle to compete in the global innovation economy. One metric that is often cited as proof of this is the number of patents we are granted in comparison with other advanced countries. In this scaleup research, we have looked more closely at Canada’s performance in the numbers of patents granted.

Canadian Tech Tortoises

April 2017 – Anecdotal evidence suggests that many Canadian technology companies wait until their products are completed before raising and spending funds on crucial functions, including marketing and sales (M&S) and that this practice is delaying success in raising funding.

Failure to Scale

Feb 2017 – Policy experts and innovation practitioners have criticized Canada’s innovation system for its inability to grow and scale companies. This has been a baffling issue because Canada’s technology sector has been successful at starting companies and generating innovations with high potential. In this study we wanted to determine whether the way in which Canadian companies raise funds also adding to the scaling problem?

A Nation of Soft Sellers

Jan 2017 – Our success as an “Innovation Nation” depends not only on our ability to come up with novel ideas or inventions but also on our ability to market and sell those ideas. Unfortunately there is a striking difference in the spending behaviour of Canadian and American on marketing and sales (M&S).

Canada’s VC Puzzle

Sept 2016 – The lack of venture capital in Canada has been denounced consistently in studies and think tank reports, and by the media, entrepreneurs, and even venture capitalists themselves. But while the general consensus is that Canada does not have enough venture capital, we somehow manage to rank #4 in the sale of technology companies.

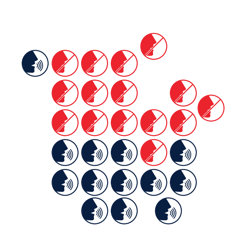

Attitudes to Innovation

May 2016 – Our study on attitudes towards innovation found that there are 29% more Americans than Canadians who have a strongly positive attitude towards innovation. Americans outscore us in almost every dimension of attitudes towards innovation, among managers and employees, men and women, and among all age groups.

Losing Count

April 2016 – While many reports bemoan Canada’s lack of spending on Innovation compared with the OECD, we haven’t been using the same definition of R&D and this has caused it to be under-reported. Furthermore, numerous reports on Canada’s innovation economy have pointed out not only that Canada’s BERD expenditures are lower than the OECD average but also that they appear to be declining over time.

Ousting the Founder

March 2016 – In my second study on Canada’s innovation challenges, I’ve determined that Founder CEOs outperform Professional CEOs in both Unicorns (privately held companies with valuations in excess of $1 billion) and venture capital-backed Canadian companies. But in Canada we are 2.5 times more likely to replace a Founder CEO with a Professional CEO.

Thinking Inside the Box

Feb 2016 – My first study at the Impact Centre has shown that Canadians lag Americans in their attitudes to innovation. The study found that there are 29% more Americans than Canadians who have a strongly positive attitude towards innovation. Americans outscore us in almost every dimension of attitudes towards innovation, among managers and employees, men and women, and among all age groups.