Perspectives

A New Understanding of Intellectual Property

Technology, government and university leaders need a new understanding of intellectual property. It’s no longer enough to think of Technical IP in isolation. To succeed today, we need to take a broader view in which Marketing IP and Process IP are recognized as...

Scaling up in a Recession

Are you wondering about what to do about scaling up in a recession? We are now nearly two months into a combined health and economic crisis. Many companies will have had a chance to address cash flow and strategic issues. Are you ready to examine your cash flow and...

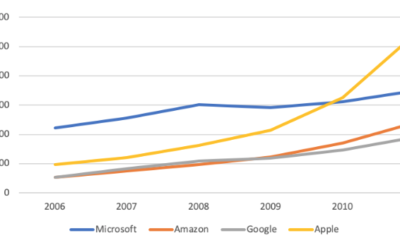

Innovation Spending in a Recession

Recent recessions in 2001 and 2008 can give us valuable insight into what we should do to optimize the results from innovation spending in a recession. There is a pattern to what successful firms have done in past recessions and it is as follows: Successful firms...

The Narwhal List 2020

The Narwhal List 2020 - 2019 was another remarkable year for Canadian Narwhals. In particular, there were 9 financings of Narwhals that exceeded $100 million (all amounts in $US). Two of these financings were in healthtech and 7 in computer technology. Of particular...

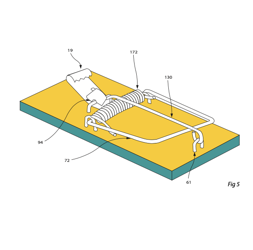

The Myth of a Better Mousetrap

Commonly used productivity and innovation indicators show Canada’s innovation economy declining relative to other countries. Despite large public investments, Canada still trails most of the Organisation for Economic Co-operation and Development (OECD) countries on...

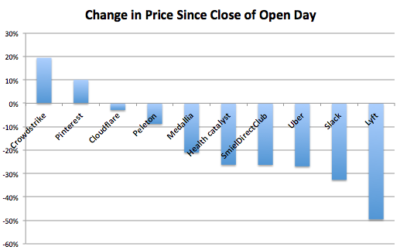

Growth or Profit – What is the Market Saying?

This year's crop of IPOs has had lacklustre returns. So much so, in fact that people have begun to suggest that the market is moving away from valuing growth over profit. Of course, given a chance to play with stats instead of working, I picked stats and proceeded to...

Does Canada Have Enough Venture Capital?

In Canada, access to venture capital (VC) is cited as a persistent barrier to the creation of world-class firms, prompting the development of programs and funds to overcome it. Policy is operating under the assumption that availability of VC funding is as much a...

Why WeWork Blinked

I met with someone yesterday who has an office at WeWork and was pleased to see the relaxed atmosphere, posters advertising Meditation Hour, and beer on tap. (It was morning so I couldn't have any beer.) That visit reminded me that I wanted to look at their prospectus...

The Narwhal List – July 2019 Update

There has been a lot of action in the Canadian tech scene over the last six months. Deals are happening with increased regularity and for bigger amounts. We thought it would be worthwhile to update the Narwhal List for July 2019 to show what has happened over the last...