This year’s crop of IPOs has had lacklustre returns. So much so, in fact that people have begun to suggest that the market is moving away from valuing growth over profit. Of course, given a chance to play with stats instead of working, I picked stats and proceeded to look to see if there is any merit to the claim.

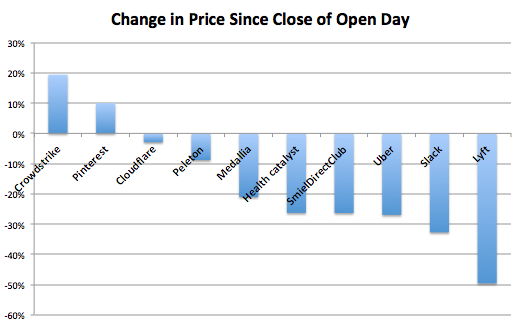

First let’s look at what happened to the 10 biggest tech IPOs of the year in terms of their change in value since opening day close. The following chart shows the dismal returns I was talking about. Only two of the ten have gone up since the end of opening day. In fact Lyft and Slack have plummeted (but in the case of Slack, it has only fallen back to its issue price.)

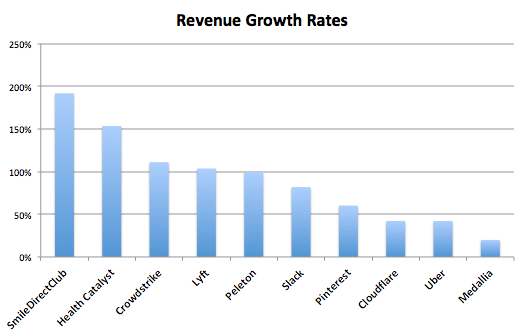

In terms of Revenue Growth Rates, this is for the most part, a great crop of IPOs.

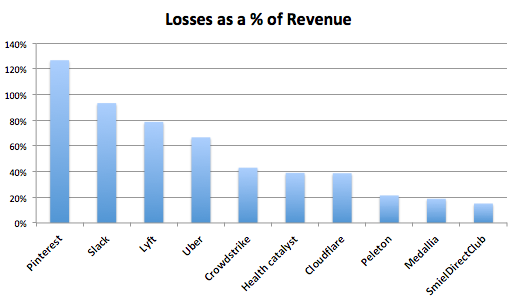

But at the same time, every single one of these companies is still losing money. And we’re not talking about a little money, but a lot. Gobs and gobs of losses in fact.

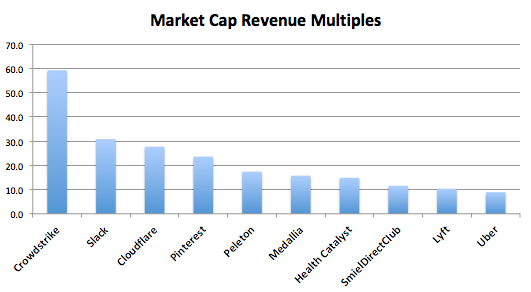

And how are they doing? Just fine thanks. In fact they all have very healthy revenue multiples (In fact Crowdstrike’s is frankly obscene.)

And what is the relationship between these factors? There isn’t one and let me tell you I tried to find one. I graphed them all and put in trendlines. I calculated correlations. I even changed my method of analysis to use rankings instead of absolute numbers and I couldn’t get any correlation worth talking about other than between losses and growth. As we know the more you lose the more you can grow.

But as to the assertion made by analysts that the market has forsaken growth in favour of companies that might be able to make money some day? Nope, this data doesn’t say that. What it says is absolutely nothing. (And to think I wrote a blog about statistics that don’t show anything.) Whatever…go back to work and grow, grow, grow. The big stats still show that growth is the best driver of shareholder value so lose away and wait till the next downturn when we might have a new normal.