Market Development Research

Creating World Class Companies

In this report we want to go back to the beginning and look at the nature of technology companies that are being formed in Canada.

Scaling Up

This report is full of growth metrics for software companies. The beginning section is on market size.

Canadian Tech Tortoises

Anecdotal evidence suggests that many Canadian technology companies wait until their products are completed before raising and spending funds on crucial functions, including marketing and sales (M&S) and that this practice is delaying success in raising funding.

A Nation of Soft Sellers

Our success as an “Innovation Nation” depends not only on our ability to come up with novel ideas or inventions but also on our ability to market and sell those ideas. Unfortunately there is a striking difference in the spending behaviour of Canadian and American on marketing and sales (M&S).

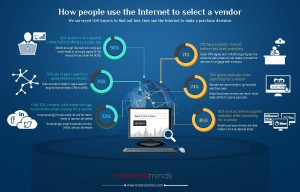

How Buyers Use the Internet to Select a Vendor

The Internet has drastically changed the dynamics between buyers and sellers and this shift has presented both tough challenges and great opportunities for sales and marketing departments. The landscape has changed from sellers “pushing” their wares to one where buyers now “pull” what appeals to them in their own way and at their own pace. Companies stuck in the old growth paradigm will eventually find it more difficult to compete and survive. Some may be feeling the pain already. We recently conducted some research to understand how the buying process has changed and how decision-makers rely on technology to: find potential solutions to their problems; narrow down potential vendors; and select the short-list of those lucky enough to participate. We surveyed 500 business people across industries to find out how buyers use the Internet when they are ready to buy. The context of the research and this report applies to consumer behavior on many levels, but has particular relevance to the B2B buying process.

Are you Spending Enough on Sales and Marketing?

Always a key question for any business leader is “how much should I spend on sales and marketing?” We researched 350 public companies in the software industry to understand the relationship between investments in sales and marketing and revenues.

The problem is that many companies expect to be able to grow without devoting enough resources to this critical expense area. They wonder why they can’t beat the competition consistently when they are being outspent. If it is true that you have to touch a prospect seven times before he becomes a customer then you have to have enough resources in sales and marketing to be able to do reach out to a prospect on a consistent basis.

If you want to see the high-level results of our research, click the button on the right to view the infographic. If you want to see how your company compares with others, contact us for detailed benchmarks.