Perspectives

Strategic Questions

I spend a fair bit of time trying to develop frameworks to guide business analysis and in a meeting yesterday I realized that the one I had adopted to ask companies about their business strategy was too loosey goosey. The four strategic questions I typically asked...

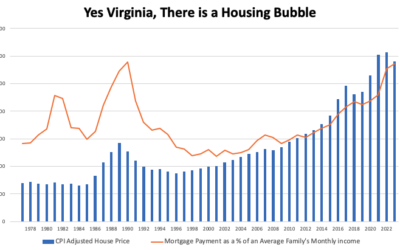

Yes Virginia, There is a Housing Bubble

There’s lots of talk about there being a housing bubble in Toronto and finally after 10 years of claiming this, people are right. I guess if you keep crying fire, eventually one will happen, and you’ll be right. What has happened to bring this bubble about is, of...

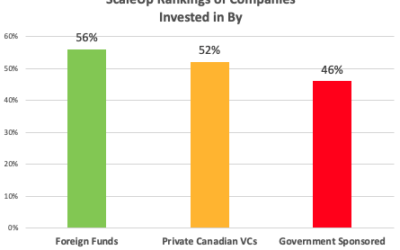

Who is Backing Canadian Winners?

When the government says it isn’t in the business of picking winners, they’re right. The data shows that they are no good at it. I crunched the numbers to see who is backing winners and the results are clear. Canadian companies backed by foreign investors are scaling...

Canadians Need an Export First Mentality – A Rant

I’m wondering when Canadian firms are going to realize that getting their initial revenue in Canada is slowing down their progress and that they need an export first mentality. Yes, this is a rant. I met another example yesterday. When we were starting Synamics as a...

Canada’s Marketing and Sales Challenge

Our national “productivity gap” has spurred analyses, reports, and media articles for decades. While public debate in Canada has focused on productivity improvement for over 50 years, we have made limited progress. Fresh thinking is required. While Innovation through...

Growth vs Profit

Several weeks ago, someone made a comment on a post of mine alleging that the “growth at all cost” model got destroyed in the 2nd half of 2022 and thus that in the battle between growth vs profit, profit now wins. He also disputed my claim that “losing money works as...

Dialogue Health Technologies

Yesterday, SunLife announced its intention to acquire Dialogue for $5.15 a share. While it’s great that it was bought by a Canadian firm, it is disappointing that Canada lost another chance to create a world leading company. When things like this happen, I like to...

The Shocking Rise in Unicorn Valuations

In early 2017, the US had 96 Unicorns. By early 2019 this count was up to 147 and last week the count was 644. That little stat blew my mind but then I looked at US Unicorn Valuations and was frankly shocked. If you want to look, check it out on CB Insights. I’ve been...

Counting Investments in Canadian Unicorns

Part of our national angst bemoans the lack of Canadian investors in Canadian Unicorns. I used to think that was a problem but lately I've come to think I was wrong. This new thinking was emphasized by a blog by Danilo Tominovic. Danilo has done a good job raising the...