We are pleased to introduce the Narwhal List for 2017. Our previous Impact Brief (A Failure to Scale, February 2017) set out to show that relative to US firms, Canadian companies have historically slower growth rates that make them less appealing to potential investors. We concluded that Canadian businesses have the potential to overcome this issue and position themselves as more attractive investments, but they must be more aggressive, raising capital earlier, more often, and in larger amounts.

Emerging technology companies that wish to attain a significant share of global markets must be able to attract substantial financing. Certainly, this has been the trend for the high-profile group of startups also known as Unicorns. A term coined by the technology markets intelligence firm, CB Insights, a Unicorn is defined as a private company with a valuation at or above $1 billion. All of these firms have been propelled to world-class status by significant injections of early- and late-stage venture capital (VC) funds. In the early stages, Canadian companies must accelerate their growth and their consumption of capital to earn the returns necessary to attract later-stage VC financing, particularly if they wish to reach and compete at the Unicorn scale.

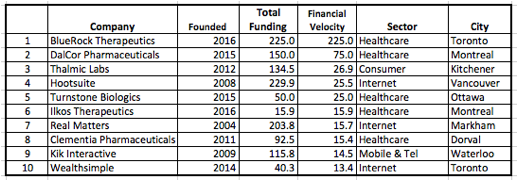

In order to provide a tool to enable entrepreneurs and investors to gauge how attractive firms are from a financial standpoint, we have, in this report, introduced a way to measure Financial Velocity. Financial Velocity is defined here as the amount of funding a firm has raised divided by the number of years it has been in existence. It is expressed in millions of dollars per year. This measure reports the rate at which companies raise and consume capital. We have assembled a list of the top Canadian businesses based on Financial Velocity and are pleased to introduce the Narwhal List. (The term Narwhal was first coined by Brent Holliday of the Vancouver-based Garibaldi Capital Advisors who graciously allowed us to use it.)

The Narwhal List identifies a set of young Canadian companies that have the potential to become companies on the world stage. It also points to possible financial pathways to turn these companies into Unicorns, which are closer to reaching public financial markets. The transition to the Unicorn scale and possibly public listings may give our firms the ability to compete on their own merits and have the currency necessary in public stock to fund acquisitions throughout the world that will lead to greater scale and world-class status.

A full up-to-date list of Narwhals is published here. The following short list shows the top Canadian companies as at December 31, 2016.

The Narwhal List 2017