Several weeks ago, someone made a comment on a post of mine alleging that the “growth at all cost” model got destroyed in the 2nd half of 2022 and thus that in the battle between growth vs profit, profit now wins. He also disputed my claim that “losing money works as long as the company is growing well.” Challenge accepted.

First off, let’s look at Snowflake, the cloud data platform. Their revenue grew last year at 69% and they had losses equal to 39% of revenue. The market rewarded them with a revenue multiple of 24.3 times. Yes, it was down from when they went public in 2019 but then who expects a company to keep up growth of 174%.

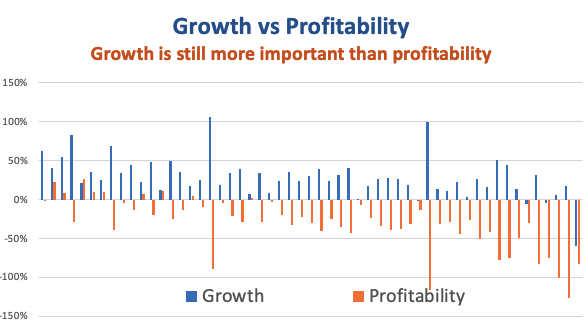

I can give lots of examples but what I prefer to look at is the story of all of these companies. To do this, I went and looked at the data on 55 software companies that went public from 2018 to 2021 (I’ll add to this sample another time) and here’s what I found.

- When these companies went public 87% were losing money and for their last fiscal, 84% were losing money. Obviously being profitable isn’t as critical as people think.

- In fact, the average rate of losses only went down from 32% to 29% since they went public.

- Meanwhile the rate of revenue growth declined from 53% to 29%.

- And what happened to their revenue multiple? It went on average from 26.6 times to 7.5 times.

Yes, the market has declined and revenue multiples are lower but it is now in a reasonable range given lower growth rates. And revenue growth is still king. In fact, the correlation between revenue growth and the revenue multiple has just fallen from 0.57 to 0.37. Meanwhile, the correlation between profit and the revenue multiple went from -0.50 to 0.03. Now at least there isn’t a negative correlation between profit and valuation, profitability is just totally unimportant.

So those of you who are talking to potential and existing investors, in the battle between growth vs profit, keep pushing for growth. Your investors (including you) will earn more in the long run.