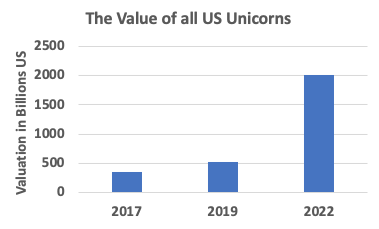

In early 2017, the US had 96 Unicorns. By early 2019 this count was up to 147 and last week the count was 644. That little stat blew my mind but then I looked at US Unicorn Valuations and was frankly shocked. If you want to look, check it out on CB Insights.

I’ve been collecting stats for a while and I find it very useful to go back and see where we have come from. In early 2017, I wanted to develop a stat that could easily express the valuation of companies. Now we really aren’t talking about a true valuation but one used for the issuance of preferred shares to VCs. Since these shares have a one or sometimes two times liquidation preference, the number computed for “valuation” is really more of a conversion threshold. This is the value at which VCs would be willing to convert their shares to common in an exit and not utilize the liquidation preference. (I may have butchered this explanation but it isn’t germane to what I saw anyway.)

Anyway, the stat I use to look at valuations is the Capital Multiple. This measures a company’s valuation relative to the amount of capital raised. It is calculated by dividing the valuation of a firm by the total amount of capital it has raised to date. I could go into a long explanation of why this multiple works to think about valuation and if you want me to, let me know.

When I last did the research, the Capital Multiple for Series A financings was sitting at about 4.7 times. That is the post money ‘Valuation” was equal to 4.7 times the total amount raised by the firm. In 2017, the average capital multiple for US based Unicorns was 5.8 times. That didn’t change much till early 2019 as by then the average was 5.5 times.

But by last week, the average Capital Multiple for US based Unicorns was 6.9 times. With the increase in numbers of Unicorns, the amount of capital invested in Unicorns had risen from $67 billion to $354 billion. But more than that, the total valuation of all Unicorns had risen from $360 billion to a whopping $2 trillion.

It takes a while for the private market valuations to fully reflect changes in public markets. But given the decline in the value of public tech stocks recently, I imagine there are going to be a few disappointed entrepreneurs and investors when they have to raise their next round of capital back in a normal valuation range.