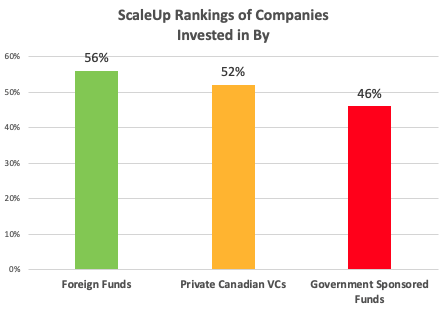

When the government says it isn’t in the business of picking winners, they’re right. The data shows that they are no good at it. I crunched the numbers to see who is backing winners and the results are clear. Canadian companies backed by foreign investors are scaling faster than those invested in by Canadian VCs and those beat ones supported by government VCs. Looking at company stats for 2,356 investments by 1,161 investors in 886 Scaling Canadian tech companies shows a definite pattern.

Foreign funds are either picking the best companies to invest in or providing them with better resources. And as can be seen from the list below, Canadian government entities have the worst record among these three groups.

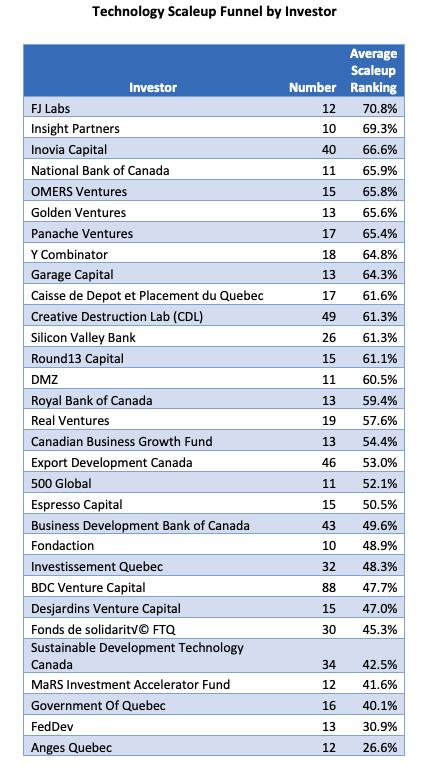

Now I know that a Scaleup Ranking isn’t the same as the level of return to investors, but it is correlated with growth which in itself is a major factor in valuation. I’ve put the list of major investors and the Scaleup rankings of companies they back below but before we get to that there are a few questions we should be asking ourselves:

- Are foreign VCs just better at picking winners?

- Or do they add more value?

- And a big question is should the government be playing this game at all?

For your enjoyment and edification, I’ve included the list of VCs with more than 10 companies in Crunchbase’s record of top 5 investors. Don’t stress out, it’s just a list, not the definitive word but an attempt to shine a light on what’s happening in the Canadian ecosystem.