Yesterday, SunLife announced its intention to acquire Dialogue for $5.15 a share. While it’s great that it was bought by a Canadian firm, it is disappointing that Canada lost another chance to create a world leading company. When things like this happen, I like to look at the economics of the company to see what they did right and what they might have done better. Fortunately, as a public company, there is lots of information on Dialogue.

Dialogue raised $100 million to go public in 2021 at a price of $12 per share, quickly rising to $17.70 but they eventually fell to $3.11 per share. Their recent sale at $5.15 recouped some of the shareholders losses but overall, they raised $465 million, went public with a value of $850 million so somebody lost money on this horse. My bet is that it was the public.

When they undertook their IPO, they looked like a total darling. With growth in the prior two years of 150% and 258%, they were rocking it. But the warning signs were there. They had raised $115 million to get to $35 million in revenue, a ratio of 3.3 times when the average in the industry at time of IPO is 2.18 times. They certainly weren’t a poster child for Canada’s claims of capital efficiency.

So, what got them to this point? When they went public, they were spending 64% of gross profit on marketing and sales, close to the IPO average of 71%. M&S was 2 times R&D, once again close to the average of 2.1 times. But they were hemorrhaging cash on general and admin at 57% of revenue, way beyond the IPO average of 21%. So, their spending on M&S and R&D propelled superb growth and overspending on G&A created losses of 57% on sales, well above the IPO average of 28%.

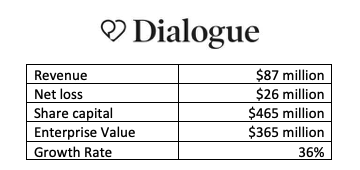

Then what happened? Well they must have had cold feet, and someone stopped spending on M&S. Spending on M&S declined as a percent of gross profit to 28% and growth fell to 36%. Not bad but not good enough to play with the big boys. R&D gained ascendancy and the ratio between M&S and R&D fell to 1.2 times while G&A continued on its bloated journey to 98% of gross profit. Losses of $26 million continued their weak record at capital efficiency which was now 5.3 times.

They probably sat at the end of 2022 with $63 million of cash in the bank and wondered what to do now. Huge losses and falling growth rates meant that they weren’t going to be able to raise more capital expect maybe at a punitive cost. They faced the prospect of continued decline in share value and probably figured they should get out while the getting out was possible.

As I see it, there were two major problems here.

- They were spending enough on M&S to fuel great growth, but they stopped doing that and growth declined.

- They were spending way too much on G&A, hemorrhaging cash because of it, driving down capital efficiency.

So sad that we lost another chance to create a world leading firm. I hope the founders made some good money on this and that they live to be founders again.