There’s lots of talk about there being a housing bubble in Toronto and finally after 10 years of claiming this, people are right. I guess if you keep crying fire, eventually one will happen, and you’ll be right.

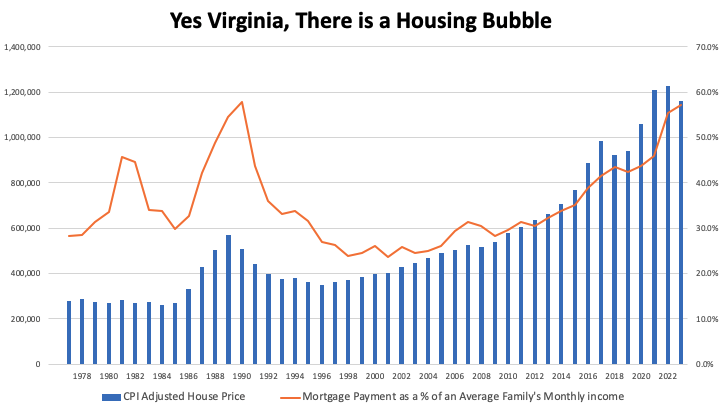

What has happened to bring this bubble about is, of course, the increasing rate of interest being charged on mortgages. The metric (did I tell you I love metrics) that really matters is the percent of a homeowner’s income that needs to be spent to pay for a mortgage. And if you look at the following graph, you’ll see that this has never been higher. (OK, maybe it was a trifle higher in 1989 but not much.)

Ideally, a mortgage might take up 30% to maybe 35% of a household’s income. Right now it takes 57.3% of the average Torontotonian’s family income to afford a mortgage on the average house in Toronto. That is bubble zone.

Way back in 2017, pre pandemic and all that, I wrote a series of blogs looking at the housing market. The first blog pointed out the oft adopted fallacy of comparing house prices to income. What I said there was that what really matters is what you have to pay in a mortgage to buy a house.

The second blog berated the Globe and mail for their demand that the government do something about surging house prices. In that blog I showed that there wasn’t a house price problem for anyone who owned a house and wanted to keep it or for those wanting to trade up. In fact, affordability had improved for that group as declining mortgage rates had improved affordability.

No, the real problem then was for new buyers. That blog showed that increasing prices made saving to buy a house a herculean task. It wasn’t as bad as 1989 but it was clearly a problem.

Right now, it is not only too expensive for a new buyer to enter the market, but it is too expensive for many homeowners to carry their house if their interest rate increases. And it is too expensive for landlords to continue to rent their houses. Now the fact that there is a bubble doesn’t necessarily mean that house prices will decline as there are four things that could happen:

- Interest rates could come down again

- Inflation could boost salaries

- Homeowners could stop eating so that they could afford their mortgages

- Or house prices could fall.

What do you think is going to happen?