by Charles Plant | Apr 30, 2019 | Entrepreneurship

This report on Entrepreneurship Education in Canada was primarily authored by Tihana Mirkovic. Higher education institutions have always played a major role in discussions on R&D and knowledge creation activities that are thought to contribute to a country’s competitive advantage on a global scale. While scientific entrepreneurship and related technology transfer have been practiced on campus in Canada and elsewhere for decades, the extent to which on-campus entrepreneurship and the “entrepreneurial spirit” have been emphasized among students has increased dramatically in the last decade. In response, the interest in the field of entrepreneurship education has also undergone a rapid expansion, with a proliferation of programs and activities. But how far has the implementation of programs come?

Optimization of the educational framework aimed at harvesting the best talent and realizing the country’s innovation potential strongly depends on understanding the landscape of the educational opportunities in entrepreneurship and innovation at Canada’s top universities. Plenty of studies have proven that education certainly plays an essential role in forming attitudes, skills, and most importantly an entrepreneurial mindset (Küttim et al., 2014; Wilson, 2008). But what is the strategy behind the current academic structure aimed at encouraging entrepreneurship and innovation education across specific fields? Which students are exposed to entrepreneurship education at the undergraduate level? Which departments or faculties tend to provide entrepreneurship programs, or teach courses on topics of innovation? From which perspectives is entrepreneurship and innovation education delivered to students? Is there a systematic framework under which curricula and programs devoted to entrepreneurship and innovation education are developed?

To answer some of these questions, we analyzed the present state of entrepreneurship and innovation education in Canada. Overall, our work identified 40 programs and 281 courses at 21 Canadian universities at the undergraduate level, with the results illustrated in Exhibit 1. This work builds on the findings presented in the first part of this investigation in which we analyzed the educational and demographic portraits of 585 founders of Canada’s fastest growing tech startups (refer to our report entitled Tech Founder Education, released in March 2019). This link helped us examine if indeed the students that are accessing entrepreneurship education are also the same students that start successful tech companies.

Our findings at a glance

Our findings indicate that entrepreneurship and innovation education is predominantly offered to business students and presented through the lens of the business faculty. Taking into account the number of students across different faculties, as well as the educational background of successful tech founders, it is evident that the delivery of entrepreneurship and innovation education within universities is skewed toward business disciplines, leaving science students with limited educational opportunities, despite their eventual success as tech entrepreneurs.

- Of the 40 programs identified: 15 are minors; 15 are concentrations; 5 are majors; and 5 are delivered as certificates.

- The majority of the programs are taught by business faculty to business students (15 programs), or engineering faculty to engineering students (11 programs).

- Out of the 281 entrepreneurship and innovation courses offered, 50.9% are taught by business faculty.

- 43.8% of courses are either electives, or electives with pre-requisites.

- Course offerings by science departments are typically limited to students only from those departments, rather than the whole science student population.

- The ratio of the number of entrepreneurship and innovation courses taught by a faculty vs. the number of students in that faculty, highlights that business students have 3.3 times more opportunity than engineers, 7.6 times more than humanities and social science students, and 8.5 times more than science students to be introduced to entrepreneurship in their specialization.

- Our previous findings on the undergraduate education of tech founders were used to determine the index of the number of courses offered by faculty/department vs. the number of tech founders specialized in that field. The results indicate that that index for business majors is 3 times higher than for humanities and social science, 6.7 times higher than for science majors, and 7.9 times higher than for engineers.

Read the full report on Entrepreneurship Education in Canada.

by Charles Plant | Feb 28, 2019 | Entrepreneurship

This report on Tech Founder Education was written primarily by Tihana Mirkovic. With the recognition of entrepreneurship playing a key role in economic growth and relevance for society, it has climbed up on the governments’ priority lists and a growing interest in entrepreneurship education has been voiced by officials, universities and students. Before we take a closer look at the current state of entrepreneurship and innovation education at Canada’s top universities, in this report, we present an analytical portrait of the educational background of some of Canada’s leading entrepreneurs. Did they receive a university education, or were they college dropouts as typically portrayed in the media? What were the most popular bachelor’s degrees in? How many founders went to graduate school? Did they have to be professors in order to realize their potential, or did they all need an MBA to make it in the startup world? Where were they educated? Is it typically men or women who start companies and how old are the founders?

To research the educational and demographic profile of entrepreneurs in Canada, we focused on the founders of Canada’s private tech companies that had accumulated funding above five million dollars. We have examined 585 founders across 335 Canadian tech companies (Exhibit 1). The companies in the study have been broadly subdivided to belong to eight different industry sectors, five which are more technical, including computer hardware and services, electronics, mobile and telecommunication, internet, and software. The other three that are more distinct include the industrial, healthcare and consumer products and services sectors. Internet, mobile and telecommunication and healthcare were the most dominant sectors for startups in this study. Most of the companies have been founded after 2000, and only six before 1990, the oldest one having been established in 1908. The distribution of founding years and their corresponding industry sectors have been depicted in Exhibit 2.

Our findings at a glance

On the surface, the most apparent and overwhelmingly clear results in our study indicate that most tech entrepreneurs are highly educated (Exhibit 1). There are, however, significant demographic differences that have also been observed once area of educational specialization of these entrepreneurs and the industry sector of the startups have been taken into account.

- 95.4% of all startup founders have a bachelor’s degree.

- At 34.9% of all undergraduate degrees, engineering was the most popular, followed by science at 21.4%.

- Founders with business, computer science or humanities and social sciences undergraduate degrees represented a smaller fraction, each at 12–14%.

- The vast majority, 79.8%, of founders received their undergraduate education at one of Canada’s universities, top five being University of Waterloo, University of Toronto, University of British Columbia, Western University and McGill University.

- 50.9% of those with a bachelor’s degree, also obtained a graduate degree. The most common graduate degree was a PhD.

- The second most prevalent graduate degree was an MBA, primarily taken by engineering and humanities, and social science students, whereas science students obtain very little business education.

- Scientists attain the highest level of education overall: 85% of undergraduate degree holders go to graduate school, while only 19% of business students get a second degree. 37% of founders with a science backgrounds hold professorships, while none of the founders with a business undergraduate degree hold academic positions.

- Only 5.8% of startup founders are women. Women with graduate degrees in humanities or social sciences make up 37% of that educational demographic – by far more than in any other sub-discipline.

Read the full report on Tech Founder Education

by Charles Plant | Jan 30, 2019 | Entrepreneurship

2018 was another remarkable year for Canadian Narwhals and we are pleased to introduce the Narwhal List 2019 here. In brief:

17 new companies joined the list last year, replacing others that no longer qualify for the list.

- 17 new companies joined the list last year, replacing others that no longer qualify for the list.

- Compared to the year before, we almost doubled the number of firms on track to become Unicorns in the near future.

- The list had a strong cohort of 25 technology companies that raised, on average, $40 million, and two healthcare companies, each averaging $100 million in new capital.The average financial velocity in the technology sector increased from 9.4 to 12.8.

- Entry to the Narwhal List is becoming more exclusive: the minimum financial velocity for entry is now 6.7 (compared to 4.7 in 2017).

- Although none of the firms on last year’s list went public in 2018, none were sold—a hopeful sign of retention in Canada.

What is highly disappointing though is that Canada has yet to produce a Unicorn since Kik Interactive became one in August of 2015. That’s over three years without producing a Unicorn when we should be producing between two and five a year. In fact since Kik became a Unicorn, 19 US companies were founded and became Unicorns.

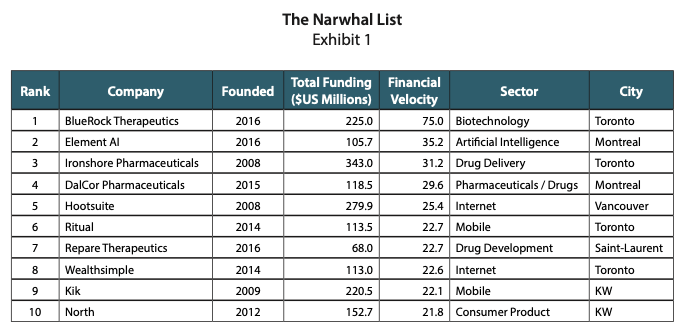

Exhibit 1 features the ten leading Canadian Narwhals.

Read the full Narwhal List 2019 here.

by Charles Plant | Nov 30, 2018 | Entrepreneurship

This report entitled Physical Technologies Part 2 is a continuation of another report you can access here. In November 2017, we issued a report on the challenges that companies in the physical technologies face in obtaining government support for commercialization. This was followed by a symposium held in February 2018 with over 100 entrepreneurs, academics, government officials, advisors, investors and other interested parties. They had a robust discussion around the challenges outlined in that report and identified a number of other hurdles, including:

- Weak institutional support structure

- Knowledge and information gaps

- Lack of critical mass

- Lack of prototyping facilities

- Absence of short-run manufacturing

- A missing global perspective

- Regulatory challenges

- Difficulties sourcing talent

- Lack of government support

- Problems with access to capital

Participants offered a range of creative solutions to these and other challenges. What emerged from these discussions is summarized in the remainder of the report. One potential path to overcome some of the barriers holding back entrepreneurs and innovators is the creation of small local clusters focused on individual physical technologies.

Not to be confused with the Superclusters launched recently by Innovation, Science and Economic Development Canada (ISED), the creation of local clusters can be done simply and cost effectively. Access to resources and services for cluster members such as peer-to-peer sessions, events, and training is a good starting point to address the challenges identified by the physical technology community. With small local clusters in place there are opportunities for further growth through the provision of centrally developed services and government support that can reach cluster members efficiently.

Read Physical Technologies Part 2 here.

by Charles Plant | Oct 30, 2018 | Entrepreneurship

This report on the Land of Stranded Pilots examines the shape of the health technology (health tech) industry in Canada with a focus on three specific questions: Does Canada actually have a problem with health tech commercialization? If so, how extensive is that problem? And what is causing it?

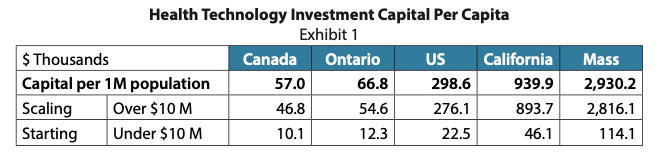

Health technologies can be divided into three primary areas: health tech software, devices and equipment for health, and biotechnology, drug discovery and development. Our review of active health tech companies in Canada and the US can be summarized in Exhibit 1. We have sorted the firms by whether they are “starting” or “scaling”, using $10 M as a cut-off between early-stage and growth (i.e. scaling) companies.

The US has five times as much capital on a population basis available to both new and growing companies. The gap grows even further for more established businesses: our neighbour has six times as much investment capital for companies that are scaling. Within the US, Massachusetts is the clear winner at overall capital and in the scale-up of companies. Relative to Ontario, it has 43 times more total capital and 51 times more investment resources for growth companies.

Canada’s underperformance, especially when we consider the wide margin in all areas of health technology, is astounding. For this reason, we will dedicate the remainder of this report to a systemic analysis of the innovation system and its components. Our analysis suggests three major factors in the underperformance.

- There is no alignment of research dollars and researchers with commercialization objectives.

- From the perspective of the entrepreneur, the system for commercializing health technology is a byzantine and flawed system with multiple overlapping, competitive, and duplicated parts with funding and assistance gaps.

- The healthcare system is not aligned to purchase the innovation that comes out of the health tech system, and in fact, can act as a brake on innovation.

This brief is not intended to be a criticism of any organization in the system or the individuals that work for those organizations. We truly have a system and people within it who are trying to do the very best job they can for their clients. Governments at all levels too are keen to develop solutions to problems in the system and have been launching new programs on a regular basis to fix problems that have been identified. All of the players are doing an excellent job meeting the needs for which they were established and addressing issues within their sphere of influence.

The problem is centered on the gradual evolution of the system as a whole. The piecemeal design over decades has created inefficiencies that no amount of hard effort by the participants in the system can change. The health tech innovation system has no measurable objectives and is plagued by misalignments, gaps, competition, and overlapping resources. The system design is flawed and must be fixed if we are to compete in health technology innovation.

Read The Land of Stranded Pilots.