We were sitting on one of those lovely Zoom calls the other day at The Happenin Company, debating about how much seed capital we should raise. Of course the simple answer is raise as much money as you need to get to a Series A round in 18 to 24 months. But it helps to know how much others are raising to understand if you are in the same ballpark. I figured I could do a bit of research and at least see if there is any way to use data to answer the question. And I figured there might be a few other people out there who might appreciate an answer so I created this blog. It is the first in what will be a series that will look at different issues in raising seed capital.

To start to put a perspective on this issue, I went back to some research I did a year ago that looked at fundraising patterns of over 500 firms in the US and Canada in late 2019. I only looked at firms that had raised over $1 million. Of the 500 or so firms, 138 of them had raised a Seed round so was included in this analysis. First up are some big stats.

The Data

The average amount raised by these firms was $2.8 million ($US) and the median raise was $2.3 million. In this sample, the biggest raise was just under $10 million. Looking at the distribution of firms by how much they raised reveals the following:

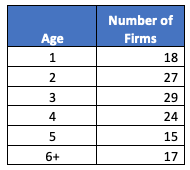

Next up in data is how old these firms are and there is no pattern to age. Firms range from brand new, under a year old to several at 7 and 8 years old and even one at 13.

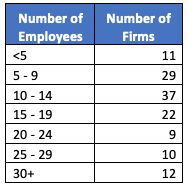

One key determinant of how much to raise is how many employees you already have. To figure this out we looked at LinkedIn. While it isn’t totally accurate, we’ve found from past research that it is directionally correct. We’ll get to this relationship in the last exhibit but meanwhile, here is the data on the distribution of firms by size in employees.

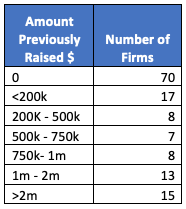

Another key determinant we found was how much a firm had raised previously, perhaps from an accelerator or a pre-seed round. We’ll get to that relationship in a second but here are the stats on previous raises:

Finally Answering the Question

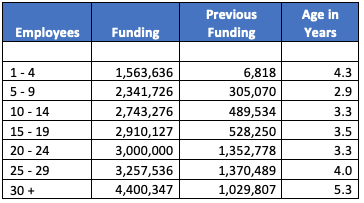

Finally we can put this all together in a picture for you. Here are the funding stats broken down into averages based upon how big a firm is in number of employees.

Every now and then, research really works out for you and this was one of those times. There appears to be a distinct relationship between how big a firm is when it raises money and how much money they raise in a Seed round. It also flows that this relationship extends to how much it has previously raised before doing a Seed round. And this makes sense. As you’re out trying to build a business you have a choice of raising pre-seed money to grow before going to raise a Seed round. The more you raise before the seed round, the farther you can get thus the bigger that you’ll be and the more you’ll raise in that seed round.

So if you’re trying to answer the question of how much seed capital you should raise, looking at the chart will give you a good idea of how to answer it. It will also help you evaluate whether you should raise a pre-seed round and build the firm up farther before raising a seed round.

This blog is part of what we discuss in a workshop series hosted by Communitech. You can find out more about it by clicking here. If you want to receive more blogs like this, you can subscribe by filling in the space on the right.

As always, amazing and clear insights

Thanks Andy!

Another insightful piece, Charles! Look forward to more.

I have to get in the habit again and figure out how to do them faster.