I posted a blog last week about D2L’s recent IPO. In it I made what on the surface may appear to be a value judgement favouring an IPO over a merger as a means for entrepreneurs to exit. This is part of the IPO versus M&A debate. I got called on it by Nicole Coviello who asked: “Why assume they want to go public? Not every tech firm wants to or needs to.” I responded that the short answer is better returns but I promised to answer fully in a post instead of as a comment so here it is.

I went and dredged up data I had on this issue as I looked at the question myself a few years ago. Some of this data may be a bit dated but it’s all I’ve got for a quick answer. If you want a better answer, maybe someone out there can do equivalent research.

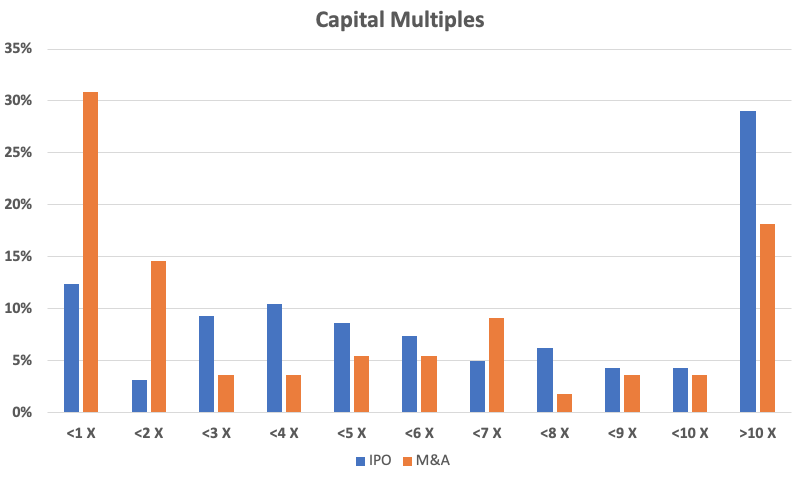

To check out rates of return for exits via an M&A event, a few years ago I collected data from CB Insights for companies in the Internet Sector (software and e-commerce) that had received more than $1 million of capital and had been sold for over $1 million at any time. In total I got data for 56 firms. The average return from this group was 7.41 times capital returned and the median was 3.52 times.

I did the same thing for IPOs checking stats I keep on all IPOs since 2013. The average return of capital from 163 software firms that exited through IPO from 2013 to 2021 was 9.7 times and the median was 5.6 times.

The following chart shows the difference between these two groups.

I’ve got other data that shows that a VC needs the average exit to have a multiple of capital returned of greater than five times to achieve an average rate of return equal to the average return over time of VC funds. This is a more complex issue as timing of investments will affect this number. An early stage VC will need a greater return of capital for instance than a later stage in order to earn similar rates of return. But I’ll save the details for another day.

So, the average IPO return of capital is 9.7 times and the average M&A return of capital is 7.41 times. The difference between return rates for IPOs versus mergers is totally logical. In the first case, there is a premium paid for liquidity and private firms earn lower valuations than public ones due to this liquidity premium. Secondly, if you are a public company buying a private one, you want an acquisition to be accretive to valuation. As a result, you’ll want to buy a firm for a lower capital or revenue multiple than you yourself are valued in the market. That way the purchase will result in a valuation bump for you.

The problem is that if you are starting a company with the intention of selling it instead of going public, you are pretty much stating that you don’t have the potential to go public and are willing to accept a lower return. Because of the difference in rates of return, any investment that a VC makes has to have the potential to go public and the fallback position for those that don’t have the economics to go public would be an acquisition. There are exceptions to this rule as some companies in hot sectors can do really well through an M&A event but for the most part the economics favour IPOs over mergers. This is why the debate between IPO and M&A isn’t really a debate. Entrepreneurs, to interest VCs should be showing why they have the potential to go public and not why M&A is their preferred route.