A number of years ago I had one of those AhHa! moments that one has when one is fiddling around doing research. Basically, I discovered the surprising way initial funding drives success. I was playing around with Crunchbase, looking at the 2,429 healthcare and computer technology businesses launched in 2008 in Canada, the US, the UK, France, and Germany to see how they had developed. Since founding 983 had obtained capital of over $100,000 to fuel their growth.

I was trying to figure out how funding fuelled growth; whether if there are patterns that could indicate the optimal amount of funding, round size, the number of rounds, when to raise capital etc. Basically, I was out fishing to see if I could catch anything close to a trend. I narrowed the research down to all software companies worldwide which had raised more than $1 million cumulatively to make results comparable. That left me with 640 companies.

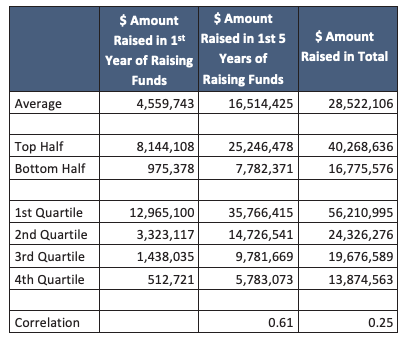

One of the tests I did was to see if there is any correlation between how much money a company raises the first time it raises funds and how they do in the long run. I stratified the results from the 640 companies into 4 quartiles, depending on how much they had raised in their first year of raising funds. The following exhibit shows the data I discovered.

These results are very clear: those firms that raised the highest amounts the first time they raised funds subsequently raised far more than firms who raised less capital in their first year of fund raising. The relationship is particularly strong in the first five years of fundraising, with a correlation of .61, showing that there is a definite advantage to raising more money the first time you raise it. This relationship is still true over the long run, though not as strong.

The logic behind this is self-evident when you look at the effect of capital on revenue. The more capital you raise, the more employees you can hire and the more revenue you can drive. Raising more money in your first year of fund raising enables you to grow faster (given a large market) and the faster you grow, the more likely you’ll be to attract investment in your next round, thus initiating an accelerated growth curve.

So, for me, the surprising way initial funding drives success is as follows:

The more money you raise the faster you’ll grow

And the faster you grow, the more money you’ll raise.

Maybe this shouldn’t have been surprising but given the way many entrepreneurs and investors talk about capital efficiency, it runs counter to common wisdom. If you’re planning on raising capital this relationship shows that it doesn’t pay to be conservative, it pays to be very aggressive, raising as much money as you can as long as you can produce results.

This blog is part of what we discuss in a workshop series hosted by Communitech. You can find out more about it by clicking here. If you want to receive more blogs like this, you can subscribe by filling in the space on the right.