by Charles Plant | May 11, 2021 | Entrepreneurship

A number of years ago I had one of those AhHa! moments that one has when one is fiddling around doing research. Basically, I discovered the surprising way initial funding drives success. I was playing around with Crunchbase, looking at the 2,429 healthcare and computer technology businesses launched in 2008 in Canada, the US, the UK, France, and Germany to see how they had developed. Since founding 983 had obtained capital of over $100,000 to fuel their growth.

I was trying to figure out how funding fuelled growth; whether if there are patterns that could indicate the optimal amount of funding, round size, the number of rounds, when to raise capital etc. Basically, I was out fishing to see if I could catch anything close to a trend. I narrowed the research down to all software companies worldwide which had raised more than $1 million cumulatively to make results comparable. That left me with 640 companies.

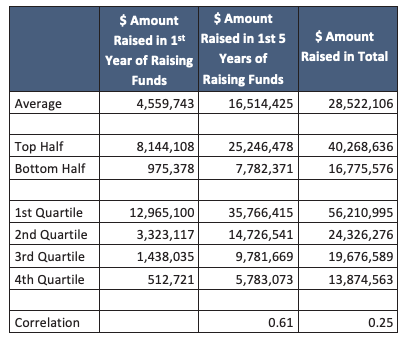

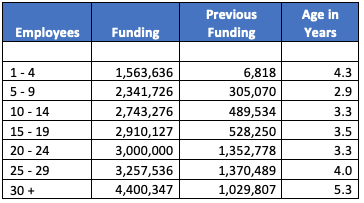

One of the tests I did was to see if there is any correlation between how much money a company raises the first time it raises funds and how they do in the long run. I stratified the results from the 640 companies into 4 quartiles, depending on how much they had raised in their first year of raising funds. The following exhibit shows the data I discovered.

These results are very clear: those firms that raised the highest amounts the first time they raised funds subsequently raised far more than firms who raised less capital in their first year of fund raising. The relationship is particularly strong in the first five years of fundraising, with a correlation of .61, showing that there is a definite advantage to raising more money the first time you raise it. This relationship is still true over the long run, though not as strong.

The logic behind this is self-evident when you look at the effect of capital on revenue. The more capital you raise, the more employees you can hire and the more revenue you can drive. Raising more money in your first year of fund raising enables you to grow faster (given a large market) and the faster you grow, the more likely you’ll be to attract investment in your next round, thus initiating an accelerated growth curve.

So, for me, the surprising way initial funding drives success is as follows:

The more money you raise the faster you’ll grow

And the faster you grow, the more money you’ll raise.

Maybe this shouldn’t have been surprising but given the way many entrepreneurs and investors talk about capital efficiency, it runs counter to common wisdom. If you’re planning on raising capital this relationship shows that it doesn’t pay to be conservative, it pays to be very aggressive, raising as much money as you can as long as you can produce results.

This blog is part of what we discuss in a workshop series hosted by Communitech. You can find out more about it by clicking here. If you want to receive more blogs like this, you can subscribe by filling in the space on the right.

by Charles Plant | May 5, 2021 | Entrepreneurship

We were sitting on one of those lovely Zoom calls the other day at The Happenin Company, debating about how much seed capital we should raise. Of course the simple answer is raise as much money as you need to get to a Series A round in 18 to 24 months. But it helps to know how much others are raising to understand if you are in the same ballpark. I figured I could do a bit of research and at least see if there is any way to use data to answer the question. And I figured there might be a few other people out there who might appreciate an answer so I created this blog. It is the first in what will be a series that will look at different issues in raising seed capital.

To start to put a perspective on this issue, I went back to some research I did a year ago that looked at fundraising patterns of over 500 firms in the US and Canada in late 2019. I only looked at firms that had raised over $1 million. Of the 500 or so firms, 138 of them had raised a Seed round so was included in this analysis. First up are some big stats.

The Data

The average amount raised by these firms was $2.8 million ($US) and the median raise was $2.3 million. In this sample, the biggest raise was just under $10 million. Looking at the distribution of firms by how much they raised reveals the following:

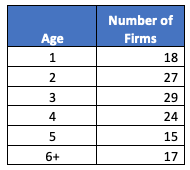

Next up in data is how old these firms are and there is no pattern to age. Firms range from brand new, under a year old to several at 7 and 8 years old and even one at 13.

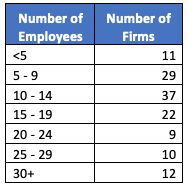

One key determinant of how much to raise is how many employees you already have. To figure this out we looked at LinkedIn. While it isn’t totally accurate, we’ve found from past research that it is directionally correct. We’ll get to this relationship in the last exhibit but meanwhile, here is the data on the distribution of firms by size in employees.

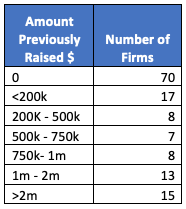

Another key determinant we found was how much a firm had raised previously, perhaps from an accelerator or a pre-seed round. We’ll get to that relationship in a second but here are the stats on previous raises:

Finally Answering the Question

Finally we can put this all together in a picture for you. Here are the funding stats broken down into averages based upon how big a firm is in number of employees.

Every now and then, research really works out for you and this was one of those times. There appears to be a distinct relationship between how big a firm is when it raises money and how much money they raise in a Seed round. It also flows that this relationship extends to how much it has previously raised before doing a Seed round. And this makes sense. As you’re out trying to build a business you have a choice of raising pre-seed money to grow before going to raise a Seed round. The more you raise before the seed round, the farther you can get thus the bigger that you’ll be and the more you’ll raise in that seed round.

So if you’re trying to answer the question of how much seed capital you should raise, looking at the chart will give you a good idea of how to answer it. It will also help you evaluate whether you should raise a pre-seed round and build the firm up farther before raising a seed round.

This blog is part of what we discuss in a workshop series hosted by Communitech. You can find out more about it by clicking here. If you want to receive more blogs like this, you can subscribe by filling in the space on the right.

by Charles Plant | Mar 30, 2021 | Entrepreneurship

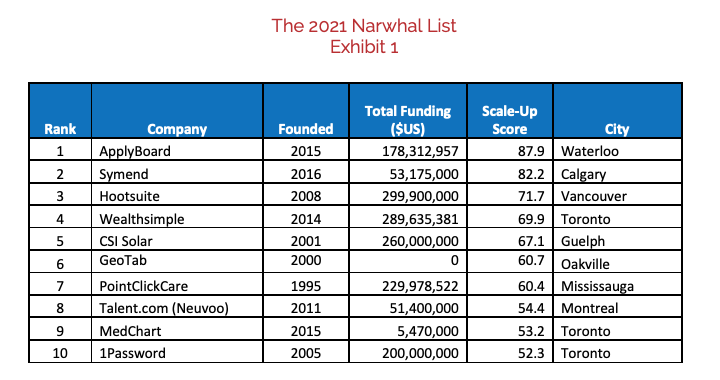

We finally got around to launching the Narwhal List 2021. 2020 was another remarkable year for Canadian Narwhals. In particular, four companies from last year’s list went public. (Nuvei, Chinook Therapeutics, Repare Therapeutics, and Fusion Pharmaceuticals.) Five were sold (Element AI, Verafin, North, Fiix, and Northern Biologics.) Of particular note, Verafin, a 17 year old company from St John’s was sold for $2.75 billion. (All Amounts $US)

Twenty five companies on the 2021 list raised a total of over $1 billion with the largest raise of the year going to CSI Solar in Guelph which raised $260 million.

Canada now has three Unicorns with PointClickCare finally being recognized as such with a valuation of $4 billion. Applyboard also joins Coveo on the list this year with a valuation of $1.5 billion

This year we have enhanced the scoring system to be able to include firms that are scaling successfully by bootstrapping. What we have created is a Scale-Up Score which reflects the success a firm is having scaling their business. This is explained further in this document. Exhibit 1 features the ten leading Canadian Narwhals. The full list is published here:

The Narwhal List 2021 V5

As would be expected, the greatest number of companies on the list is from Toronto with substantial numbers coming from Montreal and Vancouver as well.

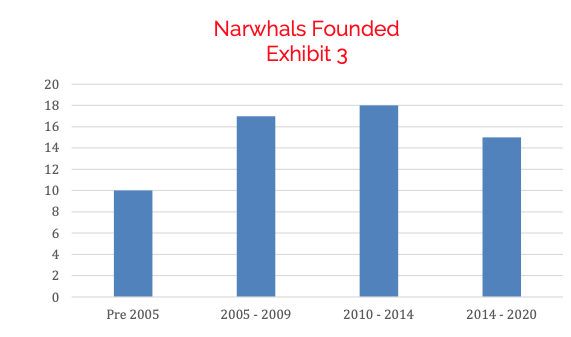

In terms of when these companies were founded, the average year of founding is 2008 with more than half founded since then.

For a white paper with more details on the Narwhal List 2021 click here.

by Charles Plant | Nov 30, 2020 | Innovation

Technology, government and university leaders need a new understanding of intellectual property. It’s no longer enough to think of Technical IP in isolation. To succeed today, we need to take a broader view in which Marketing IP and Process IP are recognized as intellectual property and, along with Technical IP, are equally valued and integrated within a new IP framework—IP 2.0.

While governments and companies may not have been thinking of IP in this manner, venture capital investors in technology startups and scaleups have been doing so for many years. VCs evaluate a prospective investment using three criteria:

Intellectual Property in the area of technology is comprised of three elements: those technical product features or manufacturing or distribution processes that give the firm a competitive advantage (trade secrets); the features of that competitive advantage that is protected by copyright or patent (patents); and regulatory approvals that the firm has been able to secure.

If Technical IP is table stakes, so is Market IP. Market IP is the knowledge that comes from identifying a large market that is ripe for disruption, understanding the needs of that market, and understanding the competition. Good Technical IP is not enough, one must have Market IP if one is to have a hope of developing a major firm.

When we look at Process IP, we are looking at the team. Do they have the knowledge and experience to take a firm to success? Do they understand the commercialization process? It is often claimed that serial entrepreneurs do better than first timers. However, research has proven this not to be the case. Research from the Centre for European Economic Research looked at 8,400 entrepreneurial ventures in Germany. They determined that “previously successful entrepreneurs were no more likely to succeed in their next venture, and that previously failed founders were more likely to fail than novice entrepreneurs.” So, there may not be Process IP owned by the entrepreneur but there are three forms of Process IP, the ownership of which can accelerate a company’s growth.

The innovation economy has forever altered the way in which companies need to develop intellectual property. To be successful entrepreneurs need to develop plans and strategies, not just for the development of Technical IP but also for the development of Market IP and Process IP. Technical IP is now only table stakes, necessary but not sufficient for success. When married though with Market and Process IP, a firm has the chance to build a highly successful business and potentially dominate world markets.

To read the white paper on A New Understanding of Intellectual Property, please click here.

by Charles Plant | May 30, 2020 | Entrepreneurship

Are you wondering about what to do about scaling up in a recession? We are now nearly two months into a combined health and economic crisis. Many companies will have had a chance to address cash flow and strategic issues. Are you ready to examine your cash flow and strategic issues? Do you need a structured approach? Here is some guidance to help you make the right decisions about how to proceed.

For solution providers who are starting or scaling and require substantial venture capital investments to be able to grow, capital may be restricted for some time. During this crisis, venture capitalists are likely to invest in fewer firms, offering lower dollar amounts and for lower valuations. Startups and scaleups that rely on capital infusions will need to conserve cash. The question: How to do that? Here is one strategy to conserve cash:

- Determine whether the markets for your products are the same or have changed and adjust plans accordingly.

- If there are no opportunities in your current market, you will need to pivot.

- If a pivot is not necessary, focus on the market segment with the best potential, instead of the entire market.

- Use this time to concentrate your R&D efforts on improving product differentiation in those markets with the highest potential.

Whether you need to slow down the growth in spending or actually reduce headcount or cut back on marketing communications spending, a strategy of focusing on the highest potential market segments will conserve cash, optimize growth and produce a plan that will be supported by existing and prospective investors. This should be done with a view to focusing on value for customers to drive growth and how this translates to value for investors.

For a white paper on Scaling up in a Recession, click here.